The Competition & Markets Authority (CMA) of the United Kingdom has just announced its provisional findings according to which (summary (PDF)) the antitrust agency has two competition concerns relating to Microsoft's $68.7B acquisition of Activision Blizzard King (NASDAQ:ATVI):

vertical foreclosure in the console market (Activision Blizzard games being potentially withheld from Sony's PlayStation)

vertical foreclosure in the market for cloud gaming services (Activision Blizzard games being potentially withheld from competitors to Microsoft's Xbox Game Pass offering)

The notice of possible remedies (PDF)

states the CMA's well-known standard approach that structural remedies (which in the end come down to either prohibiting a deal altogether or requiring the divestiture of one or more business units) are considered the way to address vertical concerns reliably and without requiring complicated monitoring and enforcement, but also

expresses a certain degree of willingness to consider access remedies, which the CMA considers to be a category of behavioral remedies.

The CMA would also listen to any other ideas, but for now I believe the discussion will center on whether a divestiture or prohibition is legally defensible--even taking into account the fairly high level of deference that CMA decisions are afforded--and whether access remedies would be appropriate and workable in this case.

Note that the CMA's thoughts concerning potential divestitures are primarily about Call of Duty, possibly the entire Activision label, and maybe Blizzard Entertainment on top, but King (Candy Crush) is not mentioned. This means the CMA has no competition concerns whatsoever concerning that game (a game of which I've mastered well over 1,400 levels).

Here's my initial reaction, without having been able to digest everything in detail yet:

I still can't say that I agree with the CMA, and as an app developer I'm disappointed that the potential benefits of the deal to mobile app makers like me don't seem to be taken into consideration. But I wholeheartedly applaud the agency for the tremendous progress it has made in the course of this investigation. I have no idea what conversations they had, and what written communications they received beyond the ones they made public. But what the CMA has published today--while still being too aggressive for my taste and failing to see the procompetitive benefits such as on app distribution as I just mentioned--is reflective of a far better understanding of the issues:

The CMA has dropped that independent theory of harm about Microsoft already owning Windows Azure (cloud service) that I called "off base" last fall. This validates my reaction. I wouldn't have stated my views so harshly if I hadn't been totally convinced that I was right and they were wrong. (I still think they're wrong by referring to Windows, which is an open ecosystem, and Azure, which is a commodity, in the cloud gaming context.)

While I struggle with the notion that a competition authority seeks to protect the market-leading console market leader (Sony), today's CMA documents make it clear that the focus is much more on the second theory of harm, which is about cloud gaming. (Even there, Sony doesn't seem to be genuinely worried about Microsoft, but at least it's a nascent market and not one in which Sony has been the undisputed leader for two decades.)

The notice of remedies reiterates the CMA's preference for divestitures, and I believe there comes a point where a long-term license is closer to a structural than a behavioral remedy. At any rate, and at risk of appearing naïve, I do believe the CMA that they are sincere about their preparedness to explore access (i.e., license-based) remedies. My reading of the notice of remedies is that such remedies may very well be deemed acceptable in the end, provided that

the terms are crystal clear,

their effectiveness is obvious,

they don't require any monitoring (which should be a non-issue because any console makers or cloud gaming service providers are sufficiently large and sophisticated organizations that they will take care of this themselves, and inform the CMA if need be), and

the CMA itself won't have to worry about enforcement (which I believe is a non-issue for the same reason as stated in the previous bullet point: the beneficiaries of any such commitments have all it takes to defend their interests).

My personal opinion is still that no remedies are needed here because there is nothing to be cured in the first place. I furthermore believe that even if any residual concerns over "cloud gaming" remained, they are eclipsed by the positive effects that the deal can have on mobile ecosystems (by creating new distribution avenuues that can serve as a competitive constraint on Apple and Google). But I can separate those views from my analysis of what the CMA has put out today versus what I saw from them last year. I think the trend is very positive. The jury is still out on what remedies will ultimately be deemed sufficient, but to me the CMA appears far more constructive than the FTC at this stage.

Let me put it this way: the CMA has certain preferences and principles, but what I've read so far (and after this post I'm going to read everything else in full detail) does not come across as the position of a dogmatically entrenched competition enforcer. I think they are being constructive in their way, and I hope I won't be proven wrong. The evolution of the CMA's thinking on where the issues are (which includes that the console part is clearly just priority #2) suggests to me that there can be a further evolution of the agency's perspective on reasonable and effective remedies.

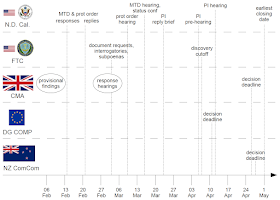

Here's my current timetable--which I first published last week--for the merger reviews and litigations in four key jurisdictions (click on the image to enlarge):

Here's a table of the key acronyms:

| N.D. Cal. | United States District Court for the Northern District of California |

| MTD | (Microsoft's) motion to dismiss (the so-called gamers' lawsuit) |

| prot order | protective order (i.e., protection of confidential business information) |

| PI | preliminary injunction |

| FTC | (United States) Federal Trade Commission |

| CMA | (UK) Competition & Markets Authority |

| DG COMP | (European Commission's) Directorate General for Competition |

| NZ ComCom | Commerce Commission of New Zealand |

I will update this chart in due course.