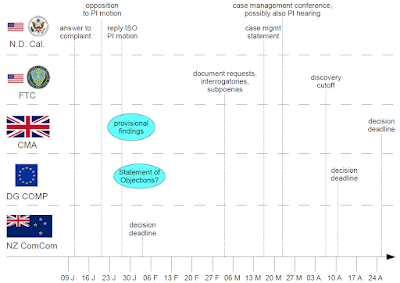

A picture is sometimes worth a thousand words when looking at complex multi-jurisdictional matters, which is why I occasionally draw up battlemaps or other charts. Here's a chart that I've just created to show the key deadlines coming up between now and late April in the ongoing reviews of (and litigations over) Microsoft's acquisition of Activision Blizzard (NASDAQ:ATVI) in four jurisdictions (United States, United Kingdom, European Union, and New Zealand) (click on the image to enlarge; it will also look at lot better if you do):

In my previous post on this topic, I provided an update on the so-called gamers' lawsuit (which is actually a lawyers' lawsuit) in the Northern District of California, which has been reassigned to United States District Judge Jacqueline Scott Corley. While only a sideshow, that piggybacking case has the potential to repeatedly make news in the months ahead by virtue of the high degree of transparency of federal civil litigation in the United States (and especially in that district).

In the FTC's in-house case (wouldn't we all like the luxury to put our cases before our own judges?), Administrative Law Judge (ALJ) D. Michael Chappell issued a scheduling order on January 4, but it was yesterday that I first spotted the order on the FTC's website. It was previously known that the trial would be held in August, subsequently to which it can take a number of months for a decision to come down. But if Microsoft and Activision Blizzard King are otherwise ready to close the deal, the FTC will have to move for a preliminary injunction in federal court, as it acknowledged at least week's case management hearing. The class-action lawyers in California are already seeking a PI, but the originally scheduled PI hearing (February 16) has been vacated and I believe the most likely date is March 23, the day for which Judge Corley has scheduled a case management conference.

The UK Competition & Markets Authority (CMA) has not stated precise dates for the various milestones between now and the final decision deadline (April 26). For instance, the publication of its findings has been slated for late January or early February, which is kind of vague.

In the EU, the key question is whether--and if so, when--a Statement of Objections would come down. An SO is a key requirement for due process reasons. Subsequently, the notifying parties get some time to file a written response (with the benefit of access to DG COMP's case file), and are entitled to a hearing. Given that certain minimum amounts of time are necessary for all of that, an SO has to issue about two months to two and a half prior to a decision deadline. The deadline here has been extended once, and could be extended again. I've seen reports that expect a hypothetical SO to be handed down in January, but I've also heard from a third-party Brussels source that the EU merger review should reach that key milestone only next month. Microsoft told ALJ Chappell that the plan was to resolve the matter in the EU and the UK based on specific commitments, which would then be proposed to the FTC. This also makes a further postponement of the EU deadline a possibility (DG COMP gets more time when commitments are offered late in the game).

There has been speculation in the media that an SO would issue prior to an agreement on remedies, but again, that is just speculation.

In merger reviews, deadlines are not always exhausted. For example, when the UK CMA gave notice of a recent extension, it explicitly stated that the objective was to reach a conclusion sooner. That's why the above chart just reflects what is publicly known today. Things can change any moment, be it because of postponements or decisions being made sooner.

The transaction has already been cleared in four jurisdictions, most recently Chile.